How to Form an LLC for “Free” in 2026

From Zero to a Fully Registered CompanyForming a Limited Liability Company (LLC) is the gold standard for protecting your personal assets. In 2026, automation has made it possible to skip expensive lawyers and do it yourself for $0 in service fees. Here is your step-by-step roadmap.

Strategic Location Selection

Where you register determines your taxes and privacy.

Home State

Usually the best choice if you have a physical office or employees there.

Wyoming

The 2026 favorite for online entrepreneurs due to zero state income tax and low annual report fees ($62).

Delaware

Best if you plan to seek Venture Capital or go public.

Naming Your Entity

Your name must be distinguishable from other businesses in the state database.

- The Check: Use the “Business Entity Search” on your Secretary of State’s website.

- The Requirement: Must end with “LLC” or “Limited Liability Company.”

- Digital Footprint: In 2026, it is vital to check if the .com and social media handles are available before filing.

Appoint a Registered Agent

A Registered Agent receives legal papers on your behalf.

The Free Way

You can act as your own Registered Agent if you have a physical address in the state where you are forming the LLC.

The Professional Way

Services like Bizee or ZenBusiness often provide the first year free, then charge ~$150–$199 annually.

Filing the Articles of Organization

This is the “Birth Certificate” of your company.

- The Process: Fill out the form on the Secretary of State’s portal.

- The Cost: You pay $0 in service fees if you do it yourself, but you must pay the State Filing Fee (e.g., $50 in Colorado, $300 in Texas).

- Wait Time: In 2026, most states process digital filings instantly or within 24 hours.

Create an Operating Agreement

This internal document outlines ownership percentages and voting rights.

Why it’s needed: Even for single-member LLCs, it proves the company is a separate legal entity from you.

The Free Way: Do not pay a lawyer $500. Use free 2026-compliant templates from eForms or Rocket Lawyer.

Obtain an EIN (Tax ID)

The Employer Identification Number (EIN) is like a Social Security Number for your business.

The Trap:

Many “Free LLC” websites will try to charge you $70+ to get this for you.

The Reality:

You can get it for FREE in 5 minutes directly from IRS.gov. It is issued instantly.

Post-Formation

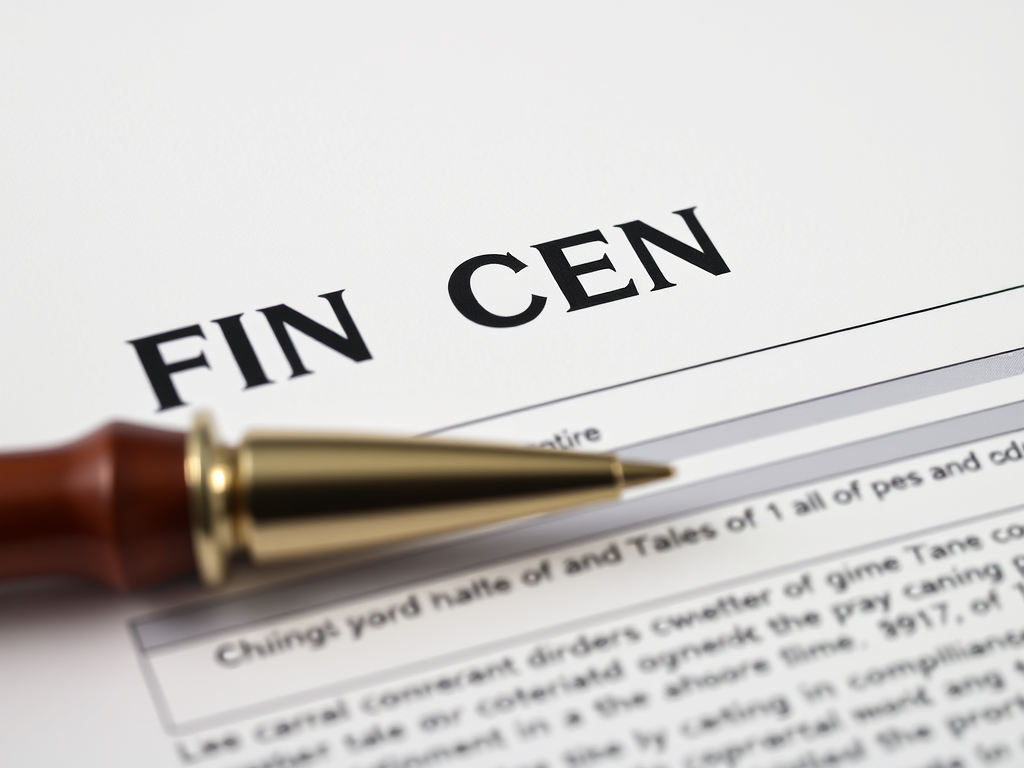

BOI Reporting (New for 2026)This is the most important step that didn’t exist a few years ago.

FinCEN Filing:

- You must report who owns/controls the company to the Financial Crimes Enforcement Network.

Études Newsletter

- $0 if filed directly on the FinCEN website.

Open a Business Bank Account

2026 Best Options:

Mercury or Relay. They are built for startups, have $0 monthly fees, and allow you to open accounts online with just your EIN and Articles of Organization.

Cost Comparison: DIY vs. Traditional

| Item | Traditional Law Firm | DIY 2026 Method |

|---|---|---|

| Service Fees | $1,000+ | $0 |

| State Filing Fee | Required | Required |

| EIN Registration | $100 | $0 |

| Operating Agreement | $300 | $0 |

| Total Savings | — | $1,400+ |

Exclusive Guide

-

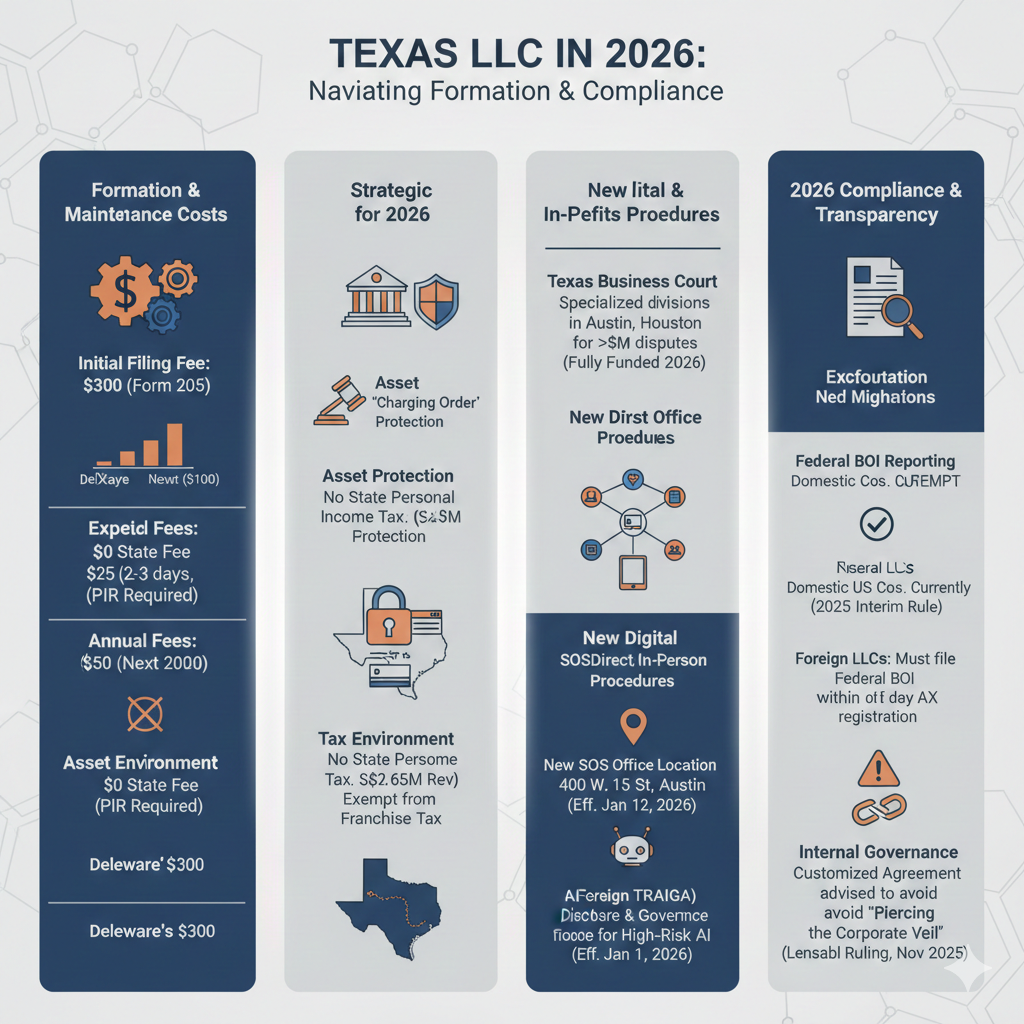

Texas LLC Formation in 2026: Costs, Benefits, and New Digital Filing Procedures

Forming a Texas LLC in 2026 requires navigating a high initial cost balanced by long-term tax advantages and new specialized legal protections. As shown in your site’s comparison themes, while Texas has a higher entry…

-

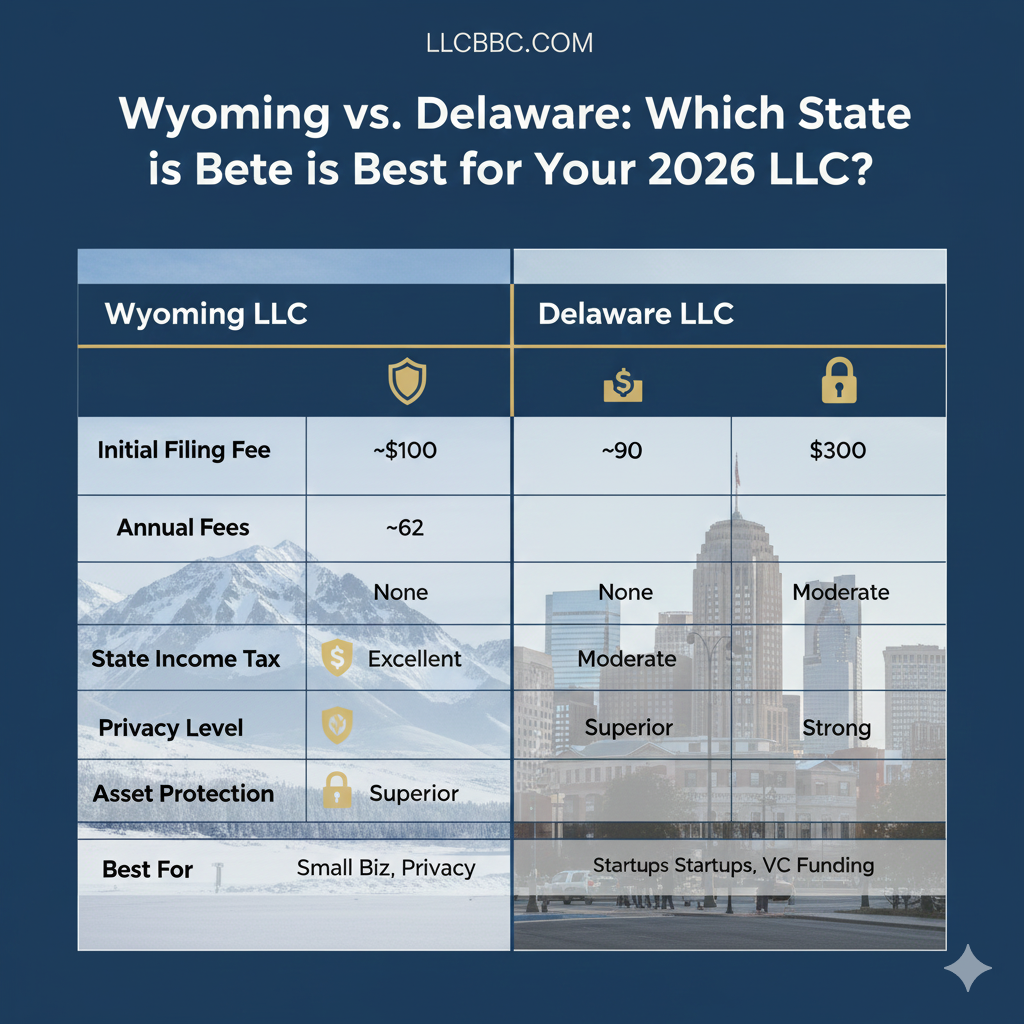

Wyoming vs. Delaware: Which State is Best for Your 2026 LLC?

Choosing the right state to incorporate your business is one of the most critical…